Table of Contents

In times of financial crisis and economic instability, banks and financial institutions are often the hardest hit, facing negative reputation and bad reviews. However, there are several ways that reputation managers can help maintain a steady and positive reputation while reducing the impact of negative reviews.

Our Approach

Studies show that over 35% of respondents consider the reputation of financial institutions to be vital. With this in mind, Reputation Maintenance, a leading reputation management agency in India, offers a team of experts in marketing, technology, public relations, and legal matters. We work closely with banks and financial institutions, including hedge funds, private equity firms, financial advisers and planners, and corporate banks, to build actionable online reputation management (ORM) strategies.

Our services focus on:

-

Controlling negative search results: We help banks and financial institutions maintain control over negative search results and reduce the impact of adverse online reviews.

-

Building positive search results: We work to create positive search results and reviews to improve the online reputation of financial institutions.

-

Generating brand awareness and online media coverage: Our team ensures that banks, financial institutions, employees, and executives engaged in financial services receive adequate brand awareness and online media coverage.

Building Authority with Social Media and Blogging

While there are regulations preventing direct marketing on third-party websites for financial advisors, social media and blogging can still be valuable tools for building a positive online presence. At Reputation Maintenance, we create active social media pages and profiles for financial advisors, helping to rank their businesses on the first page of Google and minimizing the visibility of negative reviews.

We leverage the power of trusted social media platforms such as Twitter and LinkedIn, which are highly regarded in the financial industry. Additionally, we ensure that financial advisors are listed on social media platforms tailored specifically for their profession.

Blogging is another effective medium for generating website authority. By regularly updating a blog with valuable content, financial advisors can stand out in search engine rankings and build relationships with customers. This helps to establish authority and trust within the industry.

Why is it the Right Time for Financial Institutions to Engage in Reputation Management?

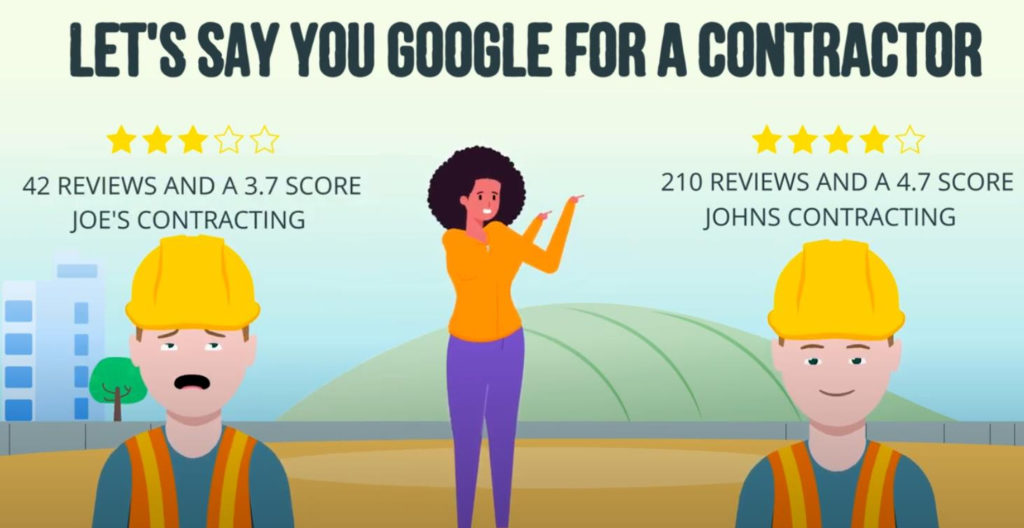

As we move towards a digital banking era, it is crucial for financial institutions to engage in reputation management. By 2022, it is predicted that over three-fourths of millennials will choose digital banking, making them a significant revenue source for the banking and finance industries. This age group heavily relies on online reviews, making online reputation management more important than ever for financial services companies.

What Do We Do for Reputation Management of Financial Institutions?

At Reputation Maintenance, we focus on promoting online reviews and positive media coverage for financial services. We help generate brand reputation and awareness for corporate banks, financial planners, and other organizations within the industry. Our ORM team consists of experts in marketing, public relations, legal matters, and technology. Building trust among the target audience is particularly important for financial institutions.

In conclusion, reputation management for financial advisors is crucial in maintaining a positive online presence amidst financial crises and economic instability. Reputation Maintenance offers comprehensive services to help banks and financial institutions control negative search results, build positive online reviews, and generate brand awareness. By leveraging social media and blogging, financial advisors can establish authority and trust within the industry. Now is the time to prioritize reputation management for financial advisors to meet the growing demand for digital banking and ensure long-term success.

2 Responses

Seeking a firm to handle my PR and on line reputation. I was slandered by crooked regulators.

Seeking a firm to handle my PR and on line reputation. I was slandered by crooked regulators. I can be reach at 206=407-6796