Table of Contents

Introduction

The importance of online reputation management for financial advisors is on the rise. In today’s digital age, your online reputation is just as significant as your offline reputation. A positive reputation can help you gain new clients and cultivate a devoted clientele, while a negative reputation can have the opposite effect. Therefore, financial advisors must take into account the significance of managing their online reputation.

In this article, we will discuss the value of managing your online reputation as a financial advisor, how to do so, how long it takes to see results, and how to improve, rebuild, and build your online reputation. Additionally, we will provide tips and best practices for effectively managing your online reputation.

Why Online Reputation Management for Financial Advisors is Important

Financial advisors should consider online reputation management for the following reasons:

Credibility and Trustworthiness

Everything in the financial sector is based on trust. Clients prefer working with advisors they can trust and who have a proven track record of success. Your credibility and trustworthiness may increase or decrease based on your online reputation. A solid online reputation can assist you in gaining the trust of current customers while establishing credibility with potential ones.

Competitive Advantage

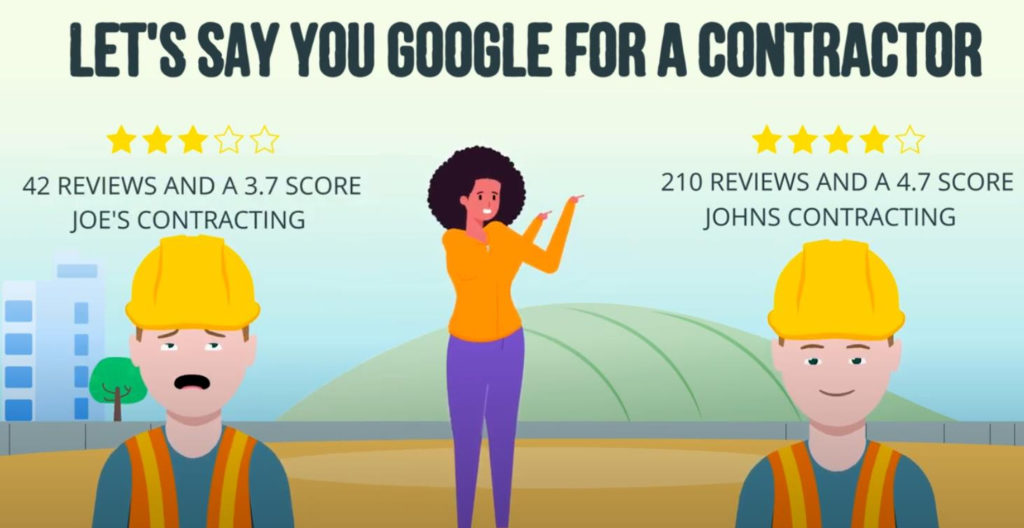

In a fiercely competitive sector like finance, having a good online reputation can help you outperform your rivals. It can assist you in standing out from the competition and attracting new customers who are looking for a dependable and trustworthy financial advisor.

Brand Management

An essential component of your personal brand is your online reputation as a financial advisor. Maintaining control over your online reputation can help you build a consistent brand image and give your current and potential customers a positive impression of you and your services.

Crisis Management

In today’s digital age, unfavorable reviews, comments, or feedback can spread like wildfire and hurt your reputation. Proactive online reputation management can help lessen the effects of any unfavorable comments, feedback, or reviews before they get out of control.

Compliance and Regulation

Financial advisors operate in a highly regulated field with exacting compliance requirements. A poor online reputation can attract the attention of regulating organizations, leading to disciplinary action.

Referrals

A positive online reputation may also result in recommendations from current customers. Financial advisors can benefit from having a strong online presence as a potent marketing tool, especially given the growing significance of online reviews and ratings.

Reputation Recovery

Financial advisors can use online reputation management to help them recover their reputation and lessen the impact on their business in the event of a negative review or damaging online content.

How to Improve, Restore, and Build Online Reputation as a Financial Advisor

Your financial advisory business may succeed or fail based on your online reputation. In today’s digital age, prospective clients are more likely to do their homework and read testimonials about you before deciding to entrust you with their money. Consequently, it’s crucial to have a solid and positive online reputation.

Financial advisors can enhance, rebuild, and cultivate their online reputation by following these tips:

1. Create and maintain a professional website

Build and maintain a professional website. Because it frequently serves as your first point of contact with potential customers, make sure it accurately represents your company and your services. Ensure your website is easy to navigate, visually appealing, and responsive to mobile devices. To help establish credibility, include a biography and a business headshot.

2. Claim and optimize your online profiles

Ensure that your business is listed on all important online directories, such as Google My Business, Yelp, and LinkedIn. Claim and optimize your online profiles. Make sure to completely fill out your profiles and ensure that all of the information is accurate and current. Encourage pleased clients to provide favorable reviews on these websites as well.

3. Monitor your online reputation

Be aware of what others are saying about you. Create Google Alerts for your name and company, and regularly check your social media accounts for any unfavorable remarks or reviews. Address any unfavorable comments promptly and professionally.

4. Engage with your audience

Using social media, financial advisors can interact with their followers and position themselves as authorities in their industry. Share information that will be helpful to your followers, such as market insights or financial planning guidance, and engage with them by responding to their comments and messages.

5. Build relationships with media outlets

Financial advisors can improve their reputation by being quoted in trade magazines or regional newspapers. Make contact with reporters and offer your financial knowledge. By doing this, you can increase your visibility and establish yourself as a trustworthy source of information.

6. Attend and speak at industry events

Speaking and attending professional conferences can help you establish your credibility as a financial advisor. This can help you connect with potential customers and business partners and establish your expertise in your field.

7. Provide excellent customer service

At the end of the day, the best way to establish and uphold your reputation is to deliver excellent customer service. Always be sincere, open, and attentive to your customers’ needs. Customers who are happy with your services are more likely to write glowing reviews and recommend you to others.

How Long Does it Take to See Results?

The extent of the issue and the actions taken to repair your online reputation will determine how long it takes to see results from online reputation management. While it might take months in some cases, in others, you might see results in a matter of weeks.

Patience is Key

It is crucial to keep in mind that ORM is a patient, long-term strategy. Your online reputation may take months or even years to significantly improve. It’s unrealistic to expect overnight success; instead, concentrate on making consistent improvements to your online presence.

Consistent Efforts

Consistency is crucial when it comes to ORM. You can’t make a few adjustments and expect to see immediate results. It is crucial to continuously monitor and manage your online reputation by consistently publishing high-quality content, interacting with your audience, and addressing any unfavorable remarks or reviews.

Time Frame Depends on Severity

The time it takes to see results also depends on how severe the negative comments or reviews are. It might take less time to see improvement if there are only a few critical remarks or reviews. However, if there is a lot of unfavorable content or reviews, it might take longer for results to show up.

Monitoring Progress

It’s crucial to monitor your progress and adjust your ORM strategy as necessary. Utilize tools like Google Alerts or social media monitoring tools to keep tabs on online mentions of your name or brand. Analyze your website’s engagement and traffic metrics to see how your efforts are affecting your online reputation.

Hire Professional Services

Consider using expert ORM services that focus on managing the online reputations of financial advisors. They can provide you with professional advice, help you create a unique strategy, and quickly implement the necessary measures to enhance your online reputation.

Conclusion

Financial advisors must control their online reputation because it has a direct impact on their credibility and professional image. A strong online presence is essential to attracting and retaining customers in the age of social media and increased internet usage. It is crucial to actively monitor and manage one’s online reputation because unfavorable reviews or comments can have a significant negative impact on a business.

This article has covered a number of strategies that financial advisors can use to enhance, repair, and build their online reputation. These strategies include producing quality content, responding to reviews, using social media, and monitoring online mentions. However, keep in mind that managing your online reputation is a continuous process that requires constant effort and focus.

By employing these tactics and being proactive in managing their online reputations, financial advisors can position themselves as reliable experts and improve their chances of success in the fiercely competitive financial sector.