Table of Contents

Reputation management is crucial for financial advisors in the digital age. In today’s digital finance landscape, your online reputation holds as much value as your investment portfolio. Trust and credibility are paramount in the financial services sector, and one wrong move or false allegation can have a significant impact on your business. That’s why online reputation management (ORM) is not just an optional strategy; it’s a necessity.

In this article, we will provide you with five tips to help you master online reputation management in the financial services sector. But first, let’s understand what online reputation management for financial service firms means.

What is Online Reputation Management for Financial Service Firms?

Online reputation management for financial service firms involves the strategic monitoring, improvement, and maintenance of the public perception of these organizations on digital platforms. Given the highly regulated nature of financial services and the sensitivity of personal and financial information involved, consumer trust is of utmost importance.

Reputation management focuses on managing online reviews, addressing negative comments promptly, promoting positive content, and ensuring that the firm’s online presence aligns with its brand values and compliance requirements. Effective online reputation management enables financial service firms to attract new customers, retain existing ones, and mitigate the impact of negative publicity.

To illustrate the importance of reputation management, let’s take a look at an example. Madden Partners, an accounting and financial planning firm, significantly improved their online reputation by using Birdeye’s all-in-one platform. They took proactive steps to build a positive brand perception, such as encouraging satisfied customers to leave positive reviews, optimizing their business listing with relevant keywords, and engaging with customers promptly. As a result, they generated 76 new reviews, experienced a 46% increase in direction requests, a 32% increase in discovery searches, and a 14% increase in Google profile views.

Why is Reputation Management Important for Financial Services?

Reputation management is crucial for financial services for several reasons:

1. Trust and Credibility

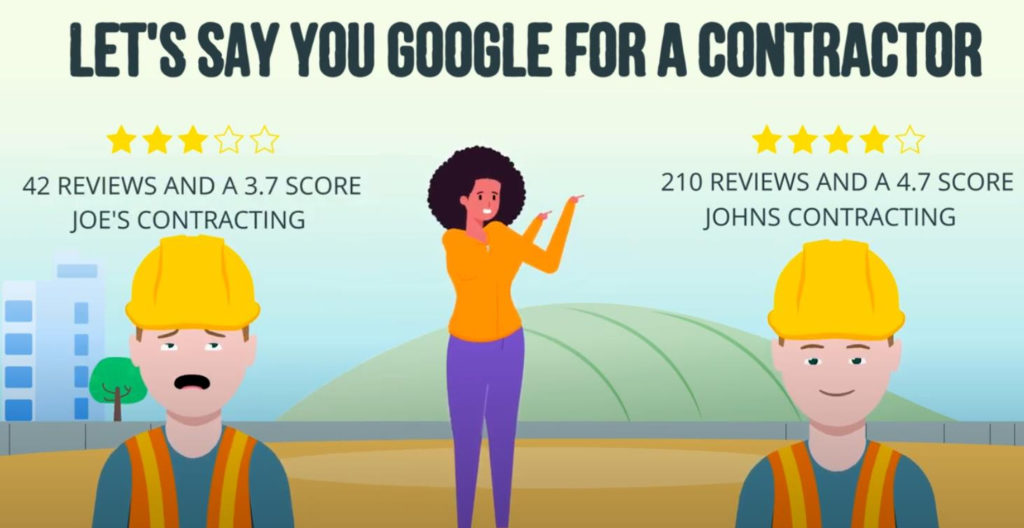

A positive reputation helps build trust among customers, investors, and the general public. Consumers are less likely to invest, open accounts, or seek financial advice from an institution that does not inspire credibility.

2. Customer Retention

Retaining customers is as important as acquiring new ones. Reputation management for financial service firms should focus on building proof of previously satisfied customers. Customers who leave positive reviews are more likely to stay with a brand they trust and are likely to make repeat purchases.

3. Risk and Crisis Management

A strong reputation acts as a buffer during times of crisis or economic uncertainty. Financial service institutions with solid reputations are more resilient and better equipped to weather market volatility challenges.

4. Competitive Advantage

A positive reputation sets a financial services business apart from competitors. Customers are more likely to choose a company with a strong reputation over one with a questionable track record.

5. Financial Performance

A solid reputation can increase revenue, improve shareholder value, and reduce borrowing costs. Maintaining a good reputation helps a finance firm demonstrate its commitment to ethical conduct and regulatory compliance, reducing the likelihood of regulatory scrutiny or penalties.

How Should Financial Service Firms Manage Their Online Reputation?

Now that we understand the importance of online reputation management for financial service firms, let’s discuss some ways to skillfully navigate the digital landscape and safeguard credibility and trustworthiness. Here are five tips for effective online reputation management in the financial services sector:

1. Monitor Online Conversations

Stay aware of what customers and the public are saying about your firm by monitoring online conversations on social media, review sites, and forums. Leverage AI-driven tools like Birdeye’s Insights to understand customer sentiments, enhance the experience, and outperform the competition.

2. Respond to Reviews

Respond to both positive and negative reviews promptly. It’s essential to humanize your brand and show your commitment to customer satisfaction. Birdeye’s AI-powered Review platform can help you automatically generate personalized responses for every review.

3. Update Business Information

Ensure that your business information is updated across all platforms, including Google Business Profile and review sites. This demonstrates consistency and reliability. Birdeye’s Listing solution can help you with AI-generated business descriptions that you can use across all the sites your business is listed on.

4. Stay Active on Social Media

Engage with your audience on social media by responding promptly to comments, messages, and inquiries. Share valuable financial insights to build authority and automate the content creation process to post more topical information.

5. Act on Customer Feedback

Collect insights from surveys and analyze them to understand your business’s strengths and weaknesses. Use the data to spot emerging trends and areas of opportunity. Acting diligently on customer feedback shows that you value your customers’ opinions and are committed to providing an excellent experience.

By implementing these tips, financial service firms can improve their online reputation management strategy and enhance their credibility and trustworthiness in the digital finance age.

Conclusion

In the digital finance age, online reputation is as valuable as an investment portfolio for financial service firms. Trust and credibility are essential in this highly regulated industry, and reputation management plays a crucial role in maintaining and improving them. By monitoring online conversations, responding to reviews, updating business information, staying active on social media, and acting on customer feedback, financial advisors can master online reputation management and safeguard their credibility and trustworthiness. Implementing a comprehensive reputation management strategy is essential for attracting new customers, retaining existing ones, and mitigating the impact of negative publicity.