Table of Contents

Introduction

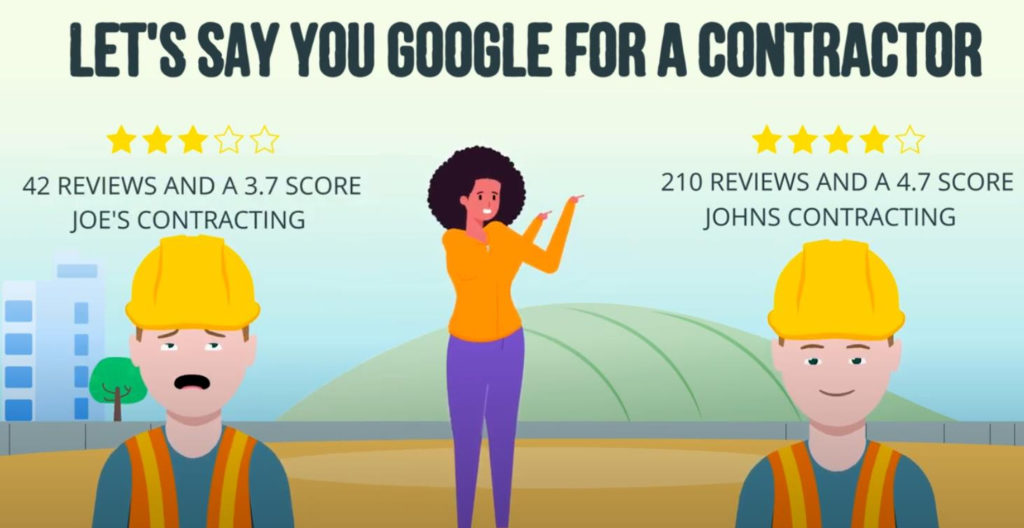

Online reputation management is a crucial aspect of a financial advisor’s virtual curb appeal. It involves cultivating a trustworthy and professional image in the digital world, where first impressions are often made. Clients want an advisor who not only talks the talk but also walks the walk, both offline and online. In this blog post, we will guide you on how to manage your online presence effectively to attract and retain the clients you desire.

What is Online Reputation Management?

Online reputation management (ORM) is like the digital landscaping for a financial advisor’s brand. It involves ensuring that the internet portrays a well-kept and inviting image of the advisor. Just like potential clients stroll down virtual streets, peeking into the professional lives of advisors, ORM ensures that when they glance at a financial advisor’s online “yard,” it leaves a lasting impression of trustworthiness and expertise.

ORM is particularly beneficial for financial advisors because:

- It creates a warm and credible first impression even before a client sets foot in the door.

- It acts as a magnet for new clients, drawing them in with a solid online presence, positive reviews, and valuable content.

- It improves visibility on search engines, making it easier for clients to find the advisor among a sea of competitors.

- It allows financial advisors to showcase their successes and client experiences, helping to shape their online narrative.

- It serves as a safety net for addressing and resolving issues swiftly and gracefully.

- It gives financial advisors a competitive advantage by presenting a polished online presence.

- It ensures compliance with industry rules and regulations.

- It provides valuable client feedback for improving services and client satisfaction.

ORM acts as a friendly digital concierge, reflecting the professionalism and high standards of the services offered by financial advisors. It helps to build strong and trusting client relationships right from the first click.

How To Manage Your Online Reputation As A Financial Advisor

Managing your online reputation as a financial advisor requires a multi-faceted approach, combining proactive brand building with reactive reputation defense strategies. Here are some practical tips to keep your digital standing polished and professional:

Monitor Your Online Presence

To effectively manage your online reputation, it is crucial to monitor your presence regularly. Here’s how:

- Set Up Alerts and Conduct Audits: Utilize tools like Google Alerts to keep tabs on mentions of your name and firm. Regularly perform searches to review your online presence.

- Respond to Reviews: Actively monitor and respond to reviews on all platforms, addressing both positive and negative feedback professionally.

- Check Privacy Settings: Manage privacy settings on personal accounts and ensure that all public information is accurate and up-to-date.

Keep Up Engagement and Interaction

Engaging and interacting with your audience is essential for maintaining a strong online reputation. Here’s what you can do:

- Build Your Brand: Maintain consistent branding across all online profiles, from your website to social media. This ensures a unified and professional image.

- Utilize Social Media: Regularly engage on social media by sharing content, interacting with clients, and participating in industry-related conversations.

- Network: Build your network by connecting with peers and influencers. This can enhance your credibility and reach.

- Ask For Feedback: Encourage positive reviews from satisfied clients and address any issues or negative publicity with tact and professionalism.

Curate Clickable Content

Creating valuable content is crucial for attracting and retaining clients. Consider the following:

- Create Your Own Resources: Publish articles, blog posts, videos, or podcasts that highlight your expertise and provide useful information to your audience.

- Perform Regular Updates: Keep your website and social media profiles fresh with regular updates, new content, and timely information.

- Stay Compliant: Ensure that all content is compliant with industry standards and regulations.

By implementing these tips, you can maintain a squeaky clean online presence and attract new and existing clients.

Best Practices for Online Reputation Management

When it comes to online reputation management, best practices align with being a financial advisor: be authentic, be transparent, and be responsive. Here’s what we mean:

Be Authentic

- Showcase Real Expertise: Share your genuine knowledge and experience. Let your content reflect your professional journey and the real value you offer.

- Highlight Your Personality: Infuse your professional profiles with elements of your personality. Clients connect better with a person they feel like they know rather than a faceless brand.

- Stay True to Your Word: Ensure that what you advertise online aligns with the services you deliver. Overpromising and underdelivering can tarnish your reputation.

Be Transparent

- Clear Communication: Always communicate your services, fees, and policies upfront and transparently to avoid misunderstandings.

- Acknowledge Mistakes: If you make an error, own up to it publicly and explain how you will rectify the situation. This demonstrates integrity.

- Disclose Affiliations: Be upfront about your partnerships or any financial incentives you might receive. Transparency builds trust.

Be Responsive

- Interact Promptly: Respond to inquiries, comments, and reviews quickly. This shows that you are attentive and care about client feedback.

- Provide Constructive Responses to Negative Feedback: When faced with criticism, respond professionally and constructively. This can turn a negative into an opportunity to demonstrate your commitment to client satisfaction.

- Active Engagement: Don’t just talk at your audience; talk with them. Engage in meaningful conversations and community building.

By following these best practices, financial advisors can maintain an online presence that accurately reflects their dedication to their clients and profession.

Conclusion

In summary, managing your online reputation as a financial advisor is crucial for creating a welcoming digital doorstep that invites clients to step in and stay awhile. By being authentic, transparent, and responsive, financial advisors can maintain a strong online presence, build trust with clients, and attract new business. Remember, in the vast world of the internet, a good reputation is your most valuable currency. Keep it shiny!