Table of Contents

- The Importance of Reputation Management

- Strategies for Reputation Management

- 1. Provide exceptional service

- 2. Monitor online reviews and ratings

- 3. Build a professional website

- 4. Develop a strong online presence

- 5. Engage with the audience

- 6. Leverage client testimonials and case studies

- 7. Seek positive media coverage

- 8. Address negative feedback promptly

- 9. Continuously educate and upskill

- 10. Seek professional assistance

- Conclusion

Financial advisors play a critical role in helping individuals and businesses manage their finances and make informed investment decisions. In a competitive industry like finance, establishing and maintaining a solid reputation is crucial for long-term success. Reputation management for financial advisors involves actively monitoring and shaping how others perceive their services and expertise.

The Importance of Reputation Management

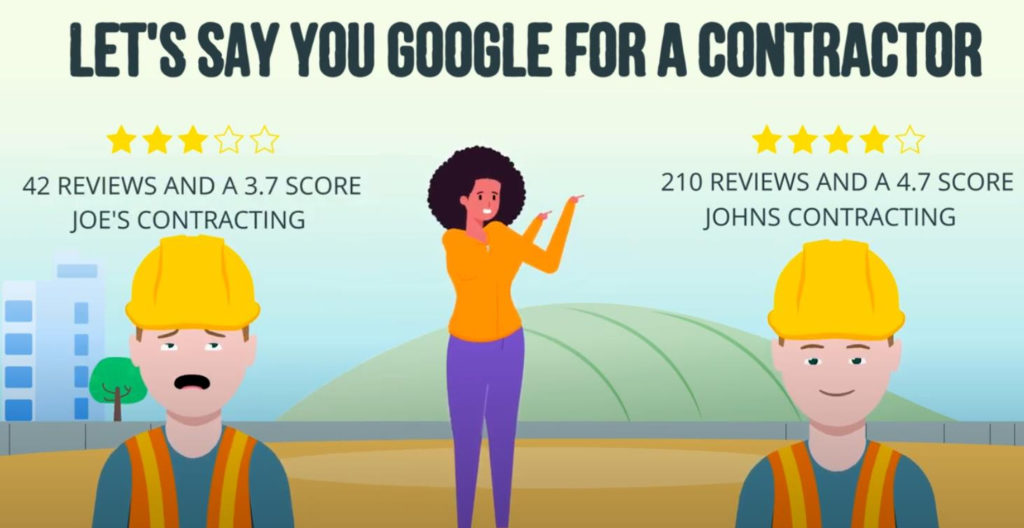

In today’s digital age, where information is readily available and easily accessible, a financial advisor’s reputation can make or break their career. Potential clients often rely on online reviews, ratings, and testimonials to evaluate the credibility and trustworthiness of financial advisors. A positive reputation can drive client acquisition and build long-term relationships, while a negative one can lead to lost opportunities and a damaged professional image.

Strategies for Reputation Management

To effectively manage their reputation, financial advisors can employ various strategies that help them establish a positive online presence and maintain a strong reputation. Here are some actionable tips:

1. Provide exceptional service

The foundation of a strong reputation is delivering exceptional service to clients. Financial advisors should prioritize client satisfaction, going above and beyond to meet their needs and expectations. By consistently delivering value and demonstrating expertise in their field, financial advisors can build a reputation for excellence.

2. Monitor online reviews and ratings

Financial advisors should regularly monitor online platforms, such as review websites and social media, for feedback and reviews from clients. Positive reviews can be leveraged to showcase the advisor’s strengths, while negative reviews should be addressed promptly and professionally. Responding to negative feedback demonstrates a commitment to client satisfaction and can help mitigate the impact of any negative comments.

3. Build a professional website

A professional website serves as an online hub for financial advisors, allowing them to showcase their expertise, services, and client testimonials. The website should be visually appealing, easy to navigate, and optimized for search engines. Including a dedicated “About” page that highlights the advisor’s qualifications and experience can instill confidence in potential clients.

4. Develop a strong online presence

In addition to a website, financial advisors should establish a strong online presence through various digital channels. This includes maintaining active profiles on social media platforms like LinkedIn, Twitter, and Facebook. Regularly sharing valuable content, such as articles, blog posts, and industry insights, can position the advisor as a thought leader and attract potential clients.

5. Engage with the audience

Engaging with the audience is crucial for building and maintaining a positive reputation. Financial advisors should actively participate in online conversations, responding to comments and inquiries promptly and professionally. Engaging with the audience demonstrates accessibility and a commitment to providing value beyond the initial client engagement.

6. Leverage client testimonials and case studies

Client testimonials and case studies are powerful tools for reputation management. Financial advisors should seek permission from satisfied clients to share their success stories and experiences. Testimonials and case studies provide social proof of the advisor’s expertise and can significantly influence potential clients’ decision-making process.

7. Seek positive media coverage

Positive media coverage can significantly enhance a financial advisor’s reputation. Advisors should actively seek opportunities to contribute to industry publications, participate in podcasts or webinars, and establish themselves as trusted sources of information. Media coverage not only increases visibility but also adds credibility and authority to the advisor’s brand.

8. Address negative feedback promptly

Negative feedback is inevitable, but how financial advisors handle it can make a significant difference in their reputation. Rather than ignoring or dismissing negative feedback, advisors should address it promptly and professionally. This could involve reaching out to the dissatisfied client privately to resolve any issues or publicly acknowledging the feedback and outlining steps taken to improve.

9. Continuously educate and upskill

To maintain a positive reputation, financial advisors must stay up to date with industry trends, regulations, and best practices. Continuously investing in professional development, attending conferences, and obtaining relevant certifications demonstrates a commitment to providing clients with the most accurate and reliable financial advice.

10. Seek professional assistance

Managing one’s reputation can be time-consuming and complex. Financial advisors can seek professional assistance from reputation management agencies or consultants who specialize in the finance industry. These experts can provide guidance on effective strategies, monitor online reputation, and help advisors navigate any reputation crises that may arise.

Conclusion

Reputation management is a critical aspect of a financial advisor’s success. By actively shaping their online presence, delivering exceptional service, and addressing feedback promptly, financial advisors can establish a positive reputation that attracts clients and builds long-term relationships. Implementing these strategies and seeking professional assistance when needed can help financial advisors effectively manage their reputation and thrive in the competitive finance industry.

Note: This article has been rewritten for the purpose of formatting and content organization. The original article can be found at https://digitalrepandreviews.com.